For Australian investors looking to engage with the U.S. stock market, understanding the nuances of trading hours across different times of the year is crucial due to the impact of Daylight Saving Time (DST) adjustments in both the U.S. and Australia. This guide will explain how these changes affect trading times and discuss the benefits of 24-hour trading support when buying in U.S. stocks from Australia.

Understanding U.S. Stock Exchange Hours

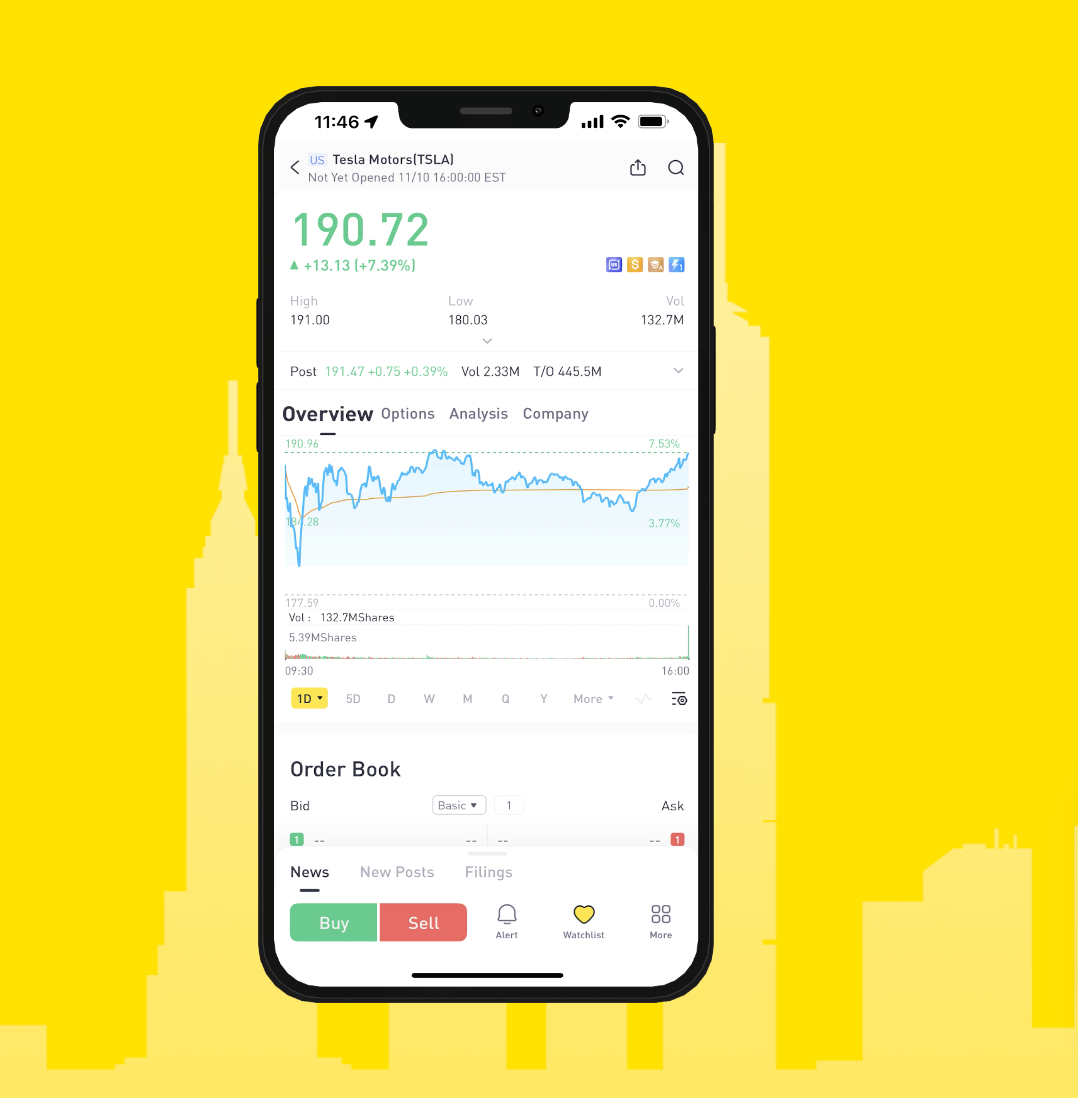

The U.S. stock market operates across several time periods: pre-market, regular market hours, post-market, and overnight trading. These phases are crucial for day traders and those looking to capitalize on market news released outside of regular hours.

Adjustments Due to Daylight Saving Time

Trading hours shift based on the observance of DST. Here’s a breakdown of the U.S. stock market hours in Australian Eastern Standard Time (AEST), which varies throughout the year:

– First Sunday in November to Second Sunday in March

– Pre-market: 20:00-01:30 AEST

– Regular hours: 01:30-08:00 AEST

– Post-market: 08:00-12:00 AEST

– Overnight: 12:00-20:00 AEST

– Second Sunday of March to the first Sunday of April

– Pre-market: 19:00-00:30 AEST

– Regular hours: 00:30-07:00 AEST

– Post-market: 07:00-11:00 AEST

– Overnight: 11:00-19:00 AEST

– First Sunday of April to the first Sunday of October

– Pre-market: 18:00-23:30 AEST

– Regular hours: 23:30-06:00 AEST

– Post-market: 06:00-10:00 AEST

– Overnight: 10:00-18:00 AEST

– October 1st Sunday to November 1st Sunday

– Pre-market: 19:00-00:30 AEST

– Regular hours: 00:30-07:00 AEST

– Post-market: 07:00-11:00 AEST

– Overnight: 11:00-19:00 AEST

These varying times can significantly impact trading strategies, especially for those who rely on updated data to make quick decisions.

The Benefits of 24-Hour Trading Support

Access to Global Markets

24-hour trading access is invaluable for Australian investors, enabling them to react immediately to U.S. market movements and news events, regardless of the local time in Australia. This capability is particularly beneficial given the significant time difference between the two countries.

Flexibility

Investors can trade at their convenience, potentially increasing their chances of capturing profitable opportunities. This flexibility is essential for those who manage their investments alongside other commitments.

Strategy Optimization

Extended hours trading allows investors to test and refine various trading strategies, including those based on news events or market trends that occur outside standard trading hours.

Conclusion

For Australian investors, navigating the complexities of U.S. stock exchanges and their varying hours due to DST can be challenging. However, platforms like Tiger Brokers offer robust solutions to these challenges. With Tiger Brokers, investors have access to comprehensive support for 24-hour trading, allowing them to capitalize on opportunities in the U.S. stock market anytime. This feature, coupled with detailed market data and a user-friendly platform, makes Tiger Brokers an excellent choice for those looking to invest in U.S. stocks from Australia.